to Refining the Hurdle Rate by Factoring in

Project Risk Premium: A Case Study

of Indonesia National Oil Company

FEATURED PAPER

By Nina Ratna Enggar Puspita

Jakarta, Indonesia

ABSTRACT

This study comprehensively analyzes the optimal hurdle rate, or the Minimum Attractive Rate of Return (MARR), for oil and gas investments in Indonesia’s National Oil Company. By incorporating country-specific, industry, and project risk into the calculation of the Weighted Average Cost of Capital (WACC), the study outlines a risk-adjusted methodology to guide investment decisions. The Analytic Network Process (ANP) method and Monte Carlo Simulation employ the lognormal distribution to quantify and analyze risk variables, establishing a project-specific risk premium. The significance of the country risk premium is emphasized, highlighting its role in investment diversification, accurate valuations, strategic decision-making, and effective risk management. The calculated hurdle rate ranges from 10,91% to 15,42%. The study underscores the importance of thorough risk analysis in ensuring sound investment decisions in the global oil and gas industry. It concludes by emphasizing the risks of setting too low a hurdle rate, leading to excessive risk-taking, or too high a hurdle rate, which might preclude potentially profitable investments.

Keywords: Analytic Network Process, ANP, WACC, Hurdle Rate, MARR, Project Risk Premium, Monte Carlo Simulation, Investment Decision, Country Risk Premium

INTRODUCTION

Opportunities in Indonesia’s Oil and Gas Sector

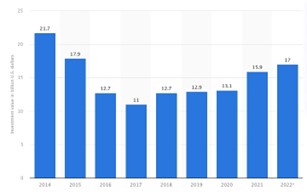

In 2022, the Indonesia oil and gas sector hit a commendable high point in terms of investment value. The target was approximately 17 billion U.S. dollars, marking a significant upsurge from previous years. The zenith of a five-year trend had seen steady increases year after year.

The year 2022’s target was a testament to the sustained growth and indicative of the sector’s vitality and increasing appeal to investors. However, it’s noteworthy that the record high remains untouched from 2014, when the investments peaked at a staggering 21,7 billion U.S. dollars, setting a benchmark for the industry’s potential.

Figure 1 – Value of investments in the oil and gas sector in Indonesia from 2014 to 2022

(in billion U.S. dollars)[1]”

Indonesia National Oil Company plays a pivotal role in the country’s energy sector. “The company has allocated a budget of US$ 5,71 billion, approximately Rp 86,64 trillion, for investment, marking a substantial increase of 44% compared to the investment realized in 2022.”[2] This move demonstrates the company’s commitment to boosting its activities in the energy sector and marks a strategic shift in its approach. “A significant portion of the investment is allocated towards drilling development wells, workovers, and well repairs,”directly impacting oil and gas production enhancement in existing wells. “The company’s plan includes drilling development wells and exploration wells, indicating an increase, and undertaking workovers and WIWS.”[3]

More…

To read entire paper, click here

How to cite this paper: Puspita, N.R.E. (2023). An Analytic Network Process (ANP) Approach to Refining the Hurdle Rate by Factoring in Project Risk Premium: A Case Study of Indonesia National Oil Company; PM World Journal, Vol. XII, Issue IX, September. Available online at https://pmworldlibrary.net/wp-content/uploads/2023/09/pmwj133-Sep2023-Puspita-analytic-network-process-approach-to-refining-hurdle-rate.pdf

Editor’s note: This paper was originally prepared during a 6-month long Graduate-Level Competency Development/Capacity Building Program developed by PT Mitratata Citragraha and led by Dr. Paul D. Giammalvo to prepare candidates for AACE CCP or other Certifications. https://build-project-management-competency.com/our-faqs/

About the Author

Nina Ratna Enggar Puspita

Jakarta, Indonesia

![]()

Nina Ratna Enggar Puspita is an engineer with 8 (eight) years of professional experience in the oil and gas sectors. Currently, she works as a cost engineer at the Indonesia National Oil Company of Indonesia. During her career, she has an experience as a Cost Estimator, Procurement Staff, Construction Engineer, Monitoring & Budgeting Officer, and Inspector. She has been involved in several projects, including Fuel Terminal, Pipeline, Jetty Facilities, and Aviation Fuel Supply Facilities.

She holds a bachelor’s degree in Industrial Engineering from Diponegoro University, a master’s degree in Business Administration from Gadjah Mada University (UGM), and a certified engineer from Bandung Institute of Technology (ITB). She is attending a distance learning mentoring course under the tutorage of Dr. Paul D. Giammalvo, CDT, CCE, MScPM, MRICS, Senior Technical Advisor (Project Management), PT Mitratata Citragraha (PTMC/APMX), to attain Certified Cost Professional certification from AACE International.

Nina lives in Jakarta, Indonesia and can be contacted at ninaratnaep@gmail.com.

[1] Statista. (2023). Value of investments in the oil and gas sector in Indonesia from 2014 to 2022. Retrieved from https://www.statista.com/statistics/993188/indonesia-investment-in-oil-and-gas/#statisticContainer

[2] CNBC. (2023). Terungkap! Investasi Pertamina Melejit, Ternyata Buat ini. Retrieved from https://www.cnbcindonesia.com/news/20230208110151-4-412048/terungkap-investasi-pertamina-melejit-ternyata-buat-ini

[3] CNBC. (2023). Pertamina Siap Jor-joran di 2023! Kucurkan Investasi Rp86 T. Retrieved from https://www.cnbcindonesia.com/news/20230207194410-4-411908/pertamina-siap-jor-joran-di-2023-kucurkan-investasi-rp86-t.

[…] Puspita, N.R.E. (2023). An Analytic Network Process (ANP) Approach to Refining the Hurdle Rate by Factoring in Project Risk Premium: A Case Study of Indonesia National Oil Company; PM World Journal, Vol. XII, Issue IX, September. Retrieved from https://pmworldjournal.com/article/an-analytic-network-process-anp-approach […]