Risk and Risk Allocation

in Public Private Partnerships

SECOND EDITION

By Bob Prieto

Jupiter, Florida, USA

Public private partnerships are much like marriages. There are good ones, bad ones, and some which just seem to struggle forward. And similar to the outset of any new marriage, each party brings to the table different assets, with different senses of value and ownership. When each brings significant assets to the table, there may be a pre-nuptial agreement that defines how those individual assets may be used in good times and how they will be divided in bad times.

For public private partnerships, comprehensive development agreements and definitive concession agreements represent the pre-nuptial basis for sharing rewards and allocating risks. Some risks will accrue to only one partner in this very public marriage while others, much like community property, will be shared.

In this paper, we will examine some of the risks that accrue to the different parties in this “marriage” and how that risk allocation changes as the nature of the marriage changes.

But first, let us spend a minute setting the stage.

Why PPPs – The Problem in a Nutshell

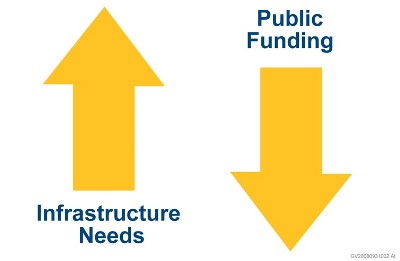

There is a multibillion-dollar backlog of unfunded major capital projects, and it is getting bigger every year. The growth in this backlog is driven not only by underinvestment in new capital expansion and deferred renewal today but also by deferred maintenance in the past. Simply, there is not enough public funding, based on current infrastructure delivery models, to meet the world’s growing infrastructure needs.

This funding gap is not just a U.S. problem but rather is very much global in scope. What are the principal drivers of this funding gap?

- Growing world population

- Increased population in the world’s urban mega-regions

- Aging infrastructure

- Inadequate funding based on “industrial” tax models

- High construction inflation growth driven by competition for scarce natural resources

- Project delivery models which fail to value risk and time

- High debt levels

Drivers of Global Funding Gap

The needs are great. Depletion and deterioration of our public infrastructure is increasing at exponential rates as can be seen in the following figure for just the United States.

And the cost of meeting those needs are daunting and only projected to grow without a changed paradigm. Today, in the United States, funding needs exceed $1.7 trillion according to the American Society of Civil Engineers, and these are only projected to grow.

More…

To read entire article, click here

Editor’s note: Second Editions are previously published papers that have continued relevance in today’s project management world, or which were originally published in conference proceedings or in a language other than English. Original publication acknowledged; authors retain copyright. This paper was originally published in PM World Today in January 2009. It is republished here with the author’s permission.

How to cite this paper: Prieto, R. (2009). Yours, Mine and Ours: Risk and Risk Allocation in Public Private Partnerships, Second Edition, PM World Journal, Vol. X, Issue XII, December 2021. Originally published in PM World Today, January 2009. Available online at https://pmworldlibrary.net/wp-content/uploads/2021/12/pmwj112-Dec2021-Prieto-yours-mine-ours-risk-allocation-in-public-private-partnerships.pdf

About the Author

Bob Prieto

Chairman & CEO

Strategic Program Management, LLC

Jupiter, Florida, USA

![]()

Bob Prieto is a senior executive effective in shaping and executing business strategy and a recognized leader within the infrastructure, engineering and construction industries. Currently Bob heads his own management consulting practice, Strategic Program Management LLC. He previously served as a senior vice president of Fluor, one of the largest engineering and construction companies in the world. He focuses on the development and delivery of large, complex projects worldwide and consults with owners across all market sectors in the development of programmatic delivery strategies. He is author of nine books including “Strategic Program Management”, “The Giga Factor: Program Management in the Engineering and Construction Industry”, “Application of Life Cycle Analysis in the Capital Assets Industry”, “Capital Efficiency: Pull All the Levers” and, most recently, “Theory of Management of Large Complex Projects” published by the Construction Management Association of America (CMAA) as well as over 800 other papers and presentations.

Bob is an Independent Member of the Shareholder Committee of Mott MacDonald and a member of the board of Dar al Riyadh. He is a member of the ASCE Industry Leaders Council, National Academy of Construction, a Fellow of the Construction Management Association of America and member of several university departmental and campus advisory boards. Bob served until 2006 as a U.S. presidential appointee to the Asia Pacific Economic Cooperation (APEC) Business Advisory Council (ABAC), working with U.S. and Asia-Pacific business leaders to shape the framework for trade and economic growth. He is a member of the Millenium Challenge Corporation advisory board where he had previously served. He had previously served as both as Chairman of the Engineering and Construction Governors of the World Economic Forum and co-chair of the infrastructure task force formed after September 11th by the New York City Chamber of Commerce. Previously, he served as Chairman at Parsons Brinckerhoff (PB) and a non-executive director of Cardno (ASX)

Bob serves as an honorary global advisor for the PM World Journal and Library and can be contacted at rpstrategic@comcast.net

To view other works by Bob Prieto, visit his author showcase in the PM World Library at https://pmworldlibrary.net/authors/bob-prieto/