A ‘Quick & Easy’ Approach for Monitoring Project Implementation

ADVISORY ARTICLE

By Kenneth F. Smith

Hawaii, USA

This article demystifies the Earned Value Methodology (EVM), and provides several practical innovative techniques to monitor, analyze and report accurate integrated project schedule & cost performance status.

Earned Value Methodology (EVM) has been around since the 1960’s and during project implementation is the iconic ‘Best Practice’ for effectively monitoring, measuring, analyzing & forecasting integrated schedule and cost performance status. However — from my experience as a practitioner, trainer, consultant and itinerant observer — EVM is the most misunderstood, and probably least-utilized technique in the project manager’s arsenal. At numerous project management meetings which I have attended, I get predominantly negative feedback to my inquiries regarding other participants’ grasp &/or on-the-job application of EV.

It seems as though even after being exposed to earned value concepts during preparation for exams — such as the Project Management Professional (PMP) of the Project Management Institute (PMI) – subsequent application of earned value is shunned. One major barrier seems to be the multiple measurements (18 at last count) of which EVM consists — replete with acronymic variables, indicators & equations.[1] After initial exposure, long-term retention is fleeting and — somewhat like calculus — atrophies for many. The other major factor is that EVM is both radically different from – as well as largely unknown by — professional accounting, financial management & auditing practices and practitioners.

This is regrettable, because without applying earned value analysis, invalid cost performance assessments are usually made, which – unless successfully rebutted by the project manager – result in inappropriate recommendations, triggering incorrect executive management decisions and action!

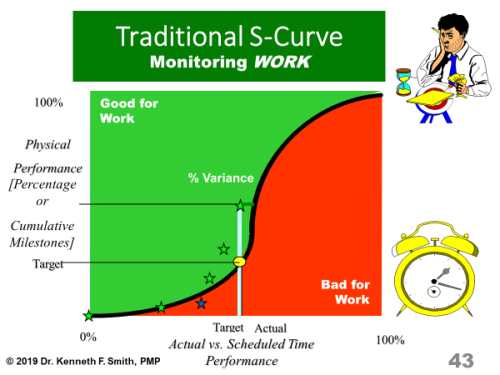

Comparing the Actual Work Completed vs. the Baseline Work Schedule during each reporting period – as shown in Figure 1 — is a logical and valid practice for monitoring physical work performance.

FIGURE 1– Work vs. Schedule

However, although perhaps useful for cash flow analysis and other financial management purposes, comparing the Actual Cost vs. the Baseline Budget Schedule for each time period (as shown in Figure 2) is insufficient, as it is not relevant – and mostly erroneous – for assessing project Cost Performance.

More…

To read entire article, click here

How to cite this article: Smith, K. F. (2019). Understanding & Applying Earned Value: A ‘Quick & Easy’ Approach for Monitoring Project Implementation, PM World Journal, Vol. VIII, Issue V, June. Available online at https://pmworldlibrary.net/wp-content/uploads/2019/06/pmwj82-Jun2019-Smith-Understanding-and-Applying-Earned-Value.pdf

About the Author

Dr. Kenneth F. Smith

Hawaii, USA

![]()

Dr. Kenneth Smith, PMP is a member of PMI and IPMA-USA, with many years of experience as a practitioner, researcher-evaluator, advisor, consultant and instructor/facilitator in project management. He was formerly a management systems specialist with the US Department of Defense; later a manager / advisor / evaluator on various sector projects — world-wide — as a representative of the US Government and the international development donor community — i.e. the U.S. Agency for International Development (USAID), the World Bank Group, African Development Bank, the UN, and the Asian Development Bank. Dr. Smith now conducts workshop-seminars in various aspects of project management, monitoring and evaluation for PMI as well as other government, academic, and private sector organizations. [These and other analytical techniques for project planning, monitoring and evaluation are contained and available in his recently published book Project Management PRAXIS, available from Amazon.]

For further information, contact Dr. Smith at kenfsmith@aol.com.

[1] Of which several indicators in this ‘formula fog’ – IMO – are exhaustively, but pedantically trivial. Furthermore, some indicators are frighteningly complex – or deceptively simple – amalgamations of indicators with variables derived from other equations, and at least one is counter-intuitively formulated with the negative resultant being a positive outcome, and vice versa! But I digress . . . !