FEATURED PAPER

By Bob Prieto

Jupiter, Florida, USA

One of the most under considered elements of cost and schedule risk is the correlation that exists within various WBS elements of a project or across projects comprising a program. Failure to adequately consider correlation between various activities and projects compounds the impact of other factors present in large complex projects.

These include:

- MAIMS – “Money Allocated Is Money Spent”

- Parkinson’s Law – work expands to fill the time allotted

- Overconfidence in assessing uncertainties

- Complexity with hidden coupling – risk events are likely to affect multiple cost elements with the potential for cascading impacts

- State of technology

- Common management, staff and work processes

- Optimism bias

- Overly simplistic probabilistic cost analysis (PCA)

This paper looks at correlation in project and program risk assessments and some of the impacts of a failure to adequately consider such correlation in project risk assessments related to both cost and schedule.

Key points:

- Recognize that correlations exist not only among cost elements in a project but among the cost elements in different projects in a program

- As correlation grows, the probabilistic cost distribution curve broadens (higher standard distribution) requiring higher budgets at a given confidence level

- As the number (n) of correlated activities in a project or projects in a program grows so too does the variance in total project costs (proportional to n2 at higher n). Correlation effects increase with the number of cost elements in a project or projects in a program

- In the absence of any correlation, the probabilistic cost distribution narrows as the number of activities or projects increases (proportional to 1/√n)

- Correlation does not change the expected costs of individual cost elements but instead only changes the “portfolio”[1] standard deviation

- The behaviors in schedule risk analysis depends on whether tasks/projects are executed serially, rolled up or executed in parallel

Correlation and its impacts in projects and programs

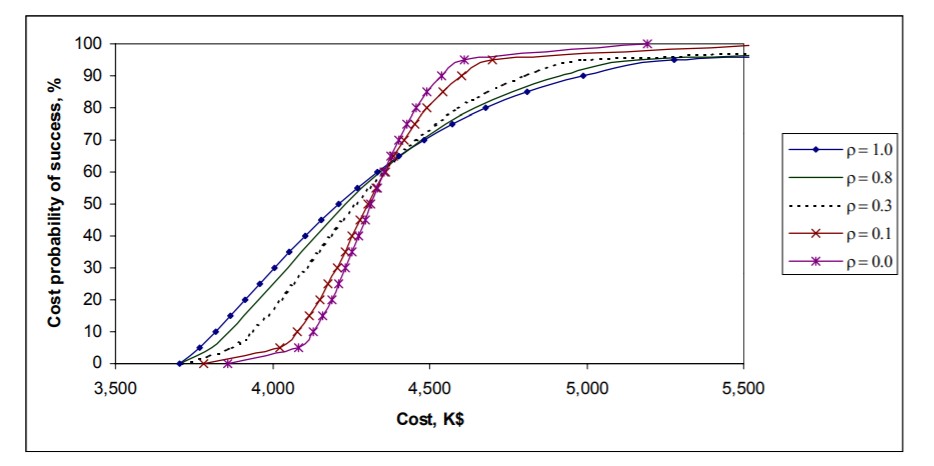

Before delving into correlation more fully, it is important to highlight the effects of correlation and some of the erroneous behaviors failing to consider it may drive. In simple terms, as correlation grows, the probabilistic cost distribution curve broadens (higher standard distribution) requiring higher budgets at a given confidence level (P65; P80 etc.).

This can be seen in Figure 1[2].

Figure 1

As the number of correlated activities in a project or projects in a program grows so too does the variance in total project costs (proportional to n2 at higher n). Correlation effects increase with the number of cost elements in a project or projects in a program[3].

More…

To read entire paper, click here

How to cite this paper: Prieto, R. (2020). The Impact of Correlation on Risks in Programs and Projects; PM World Journal, Vol. IX, Issue XII, December. Available online at https://pmworldlibrary.net/wp-content/uploads/2020/12/pmwj100-Dec2020-Prieto-impact-of-correlation-on-risks-in-programs-and-projects.pdf

About the Author

Bob Prieto

Chairman & CEO

Strategic Program Management LLC

Jupiter, Florida, USA

![]()

Bob Prieto is a senior executive effective in shaping and executing business strategy and a recognized leader within the infrastructure, engineering and construction industries. Currently Bob heads his own management consulting practice, Strategic Program Management LLC. He previously served as a senior vice president of Fluor, one of the largest engineering and construction companies in the world. He focuses on the development and delivery of large, complex projects worldwide and consults with owners across all market sectors in the development of programmatic delivery strategies. He is author of nine books including “Strategic Program Management”, “The Giga Factor: Program Management in the Engineering and Construction Industry”, “Application of Life Cycle Analysis in the Capital Assets Industry”, “Capital Efficiency: Pull All the Levers” and, most recently, “Theory of Management of Large Complex Projects” published by the Construction Management Association of America (CMAA) as well as over 750 other papers and presentations.

Bob is an Independent Member of the Shareholder Committee of Mott MacDonald. He is a member of the ASCE Industry Leaders Council, National Academy of Construction, a Fellow of the Construction Management Association of America, Millennium Challenge Corporation Advisory Board and member of several university departmental and campus advisory boards. Bob served until 2006 as a U.S. presidential appointee to the Asia Pacific Economic Cooperation (APEC) Business Advisory Council (ABAC), working with U.S. and Asia-Pacific business leaders to shape the framework for trade and economic growth. He had previously served as both as Chairman of the Engineering and Construction Governors of the World Economic Forum and co-chair of the infrastructure task force formed after September 11th by the New York City Chamber of Commerce. Previously, he served as Chairman at Parsons Brinckerhoff (PB) and a non-executive director of Cardno (ASX)

Bob serves as an honorary global advisor for the PM World Journal and Library and can be contacted at rpstrategic@comcast.net.

To view other works by Bob Prieto, visit his author showcase in the PM World Library at https://pmworldlibrary.net/authors/bob-prieto/

[1] All WBS cost elements in a project or projects in a program.

[2] Kujawski, Edouard & Alvaro, Mariana & Edwards, William. (2004); Figure 1b

[3] Book, 1999 and 2000/2001