for Project Portfolios Risk Analysis

FEATURED PAPER

By Lev Virine, Eugenia Virine, Michael Trumper

Calgary, Alberta, Canada

Project portfolios tend to be large and very complex and any comprehensive analysis of them mirrors this complexity. Project portfolio Monte Carlo risk analysis requires additional consideration as they can have a large number of projects with interdependencies between projects. This article explains a number of modeling methods which are intended to improve performance of Monte Carlo simulations.

Challenges of Portfolio Risk Analysis

On 24 June 1812, 450,000 men (up to 685,000 according to some estimates) of the Napoleon’s Grande Armée, the largest army assembled up to that point in European history, crossed the river Neman and headed towards Moscow (Britten Austin 2000). Under the guidance of Napoleon, this huge army moved rapidly towards the heart of Russia, Moscow. On September 1812 Napoleon forces entered Moscow, which had been set ablaze by retreating Muscovites. Napoleon’s army had made it to Moscow, but the city was empty and spoils few. After a month, Napoleon realized that he could not sustain the invasion and decided a retreat was in order. On the long march back to France the army faced extremely cold weather, starvation, disease, persistent attacks from the Russian army and local peasants, and inevitable desertions, which led to great losses. By November 1812, of the original half a million or so soldiers, only 27,000 fit remained in the Grand Armée, with 380,000 dead and 100,000 captured. The campaign ended on the December 14, 1812 when the last French solder left Russia and spelled the beginning of the end for Napoleon.

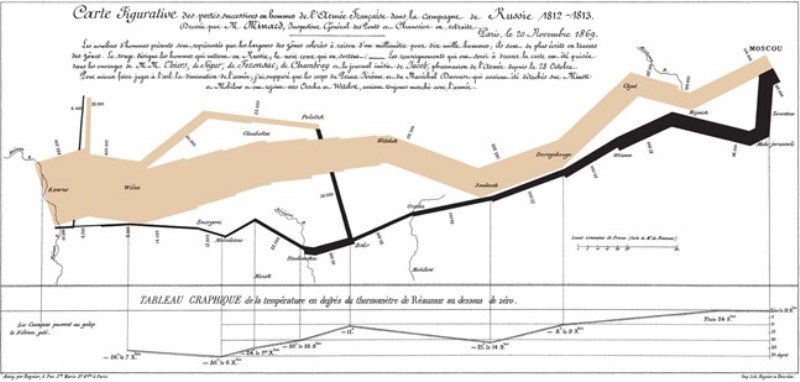

To get a better understanding or what actually happened, the map below provides a good illustration (Figure 1). It shows how the invading Grand Armée gradually shrank as it moved across Russia towards Moscow (grey line, from left to right) and back (black line, from right to left). The size of army is proportional to the width of the line. Temperatures during the retreat are plotted on the lower graph.

Figure 1. Map of Napoleon’s invasion to Russia and retreat

Napoleon lost this war without losing a single major battle, he lost because his army was not ready for a prolonged military operation across a vast land and in harsh winter conditions. Any war, especially a war on this scale is a complex project portfolio and each project has many different activities which can be impacted by many different risks. The war of 1812 was an unbelievably complex portfolio. To put this another way, could you imagine taking the entire population of Memphis, Tennessee and ordering them to go by foot or horseback (if they were so fortunate) to Chicago, Illinois over poorly maintained roads and extreme weather? Add in occasional attacks by the local population and Napoleon was planning to live off the land as he had in Central Europe, you can start to grasp the logistical nightmare Napoleon was undertaking. In the sparsely populated rural Russia of the early 19thy century, supplies, including food and forage for horses were scarce and could not keep up with the marching troops. Each battle, each maneuver, each delivery a supply convoy was essentially a project or even program and, in many cases, some of the activities have predecessors and successors in other projects. For example, before a battle, you must have supplies, but the delivery of supplies=es depends on how the security and dependability of the supply chain. This in turn, depends on the army’s ability to control the territory that they have already captured. Looking at it this way, we can start to see event chains emerging, where one risk can trigger risks across the project portfolio. In the 21st century, with all of our technology, with just in time communications etc., it is still extremely challenging to manage these type of portfolio risks, in 1812 it was virtually impossible.

Unfortunately for Napoleon’s army, any high-level portfolio risk analysis that was possible given the knowledge at the time was done incorrectly. How do we know? If he had done it properly, he surely would not have attempted such an undertaking and he would have turned his gaze away from Russia and looked elsewhere for glory and riche. 19th century European history might have been quite different if Napoleon had understood the value of portfolio risk analysis.

More…

To read entire article, click here

How to cite this paper: Virine, L., Virine, E., Trumper, M. (2021). Improving Performance of Monte Carlo Simulations for Project Portfolios Risk Analysis; PM World Journal, Vol. X, Issue II, February. Available online at https://pmworldlibrary.net/wp-content/uploads/2021/01/pmwj102-Feb2021-Virines-Trumper-improving-monte-carlo-simulations-for-portfolio-risk-analysis.pdf

About the Authors

Lev Virine, PhD

Intaver Institute

Alberta, Canada

![]()

Lev D. Virine, Ph.D. has more than 25 years of experience as a structural engineer, software developer, and project manager. He has been involved in major projects performed by Fortune 500 companies and government agencies to establish effective decision analysis and risk management processes as well as to conduct risk analyses of complex projects. Lev’s current research interests include the application of decision analysis and risk management to project management. He writes and speaks around the world on the decision analysis process, the psychology of judgment and decision-making and risk management. Lev can be contacted at lvirine@intaver.com

Eugenia Virine, PMP

Alberta, Canada

![]()

Eugenia Virine, PMP, is a senior manager for revenue development at Greyhound Canada. Over the past 12 years Eugenia has managed many complex projects in the areas of transportation and information technology. Her current research interests include project risk and decision analysis, project performance management, and project metrics. Eugenia holds B. Comm. degree from University of Calgary.

Michael Trumper

Alberta, Canada

![]()

Michael Trumper has over 20 years’ experience in communications, software design, and project risk and management. Michael is a partner at Intaver Institute Inc., a vendor of project risk management and analysis software. Michael has authored papers on quantitative methods in project estimation and risk analysis. He is a co-author of two books on project risk management and decision analysis. He has developed and delivered project risk analysis and management solutions to clients that include NASA, DOE, and Lockheed Martin.