The Sunk Cost Dilemma

Project Business Management

SERIES ARTICLE

By Oliver F. Lehmann

Munich, Germany

Summary

In Project Business Management (PBM), one can sometimes observe a dilemma situation typical for games with one player. A series of decisions needs to be made, and each time, the momentarily best and most economic option is chosen. However, the series of good decisions adds up to a major failure.

The Magic Triangle of Customer-Facing Projects

There are surprising similarities of doing projects and playing one-player games, such as the card game Solitaire (Figure 1). While the game is not played against one or more competitors, one may nevertheless win or lose. The same can apply to projects, and when the project is done under contract, additional risks can impact project success, as I will show in the following example.

There are surprising similarities of doing projects and playing one-player games, such as the card game Solitaire (Figure 1). While the game is not played against one or more competitors, one may nevertheless win or lose. The same can apply to projects, and when the project is done under contract, additional risks can impact project success, as I will show in the following example.

Figure 1: A game for one player: Solitaire

Talking with project managers in customer projects, there is often an opinion found that customer satisfaction is the only goal that one should have. It is then – correctly – emphasized that making customers happy generally justifies the existence of a project vendor company and protects its future by providing a reference that will make it easier to win incoming business opportunities. In addition, a happy customer may give the contractor the status of an incumbent provider, making it easier to make more business.

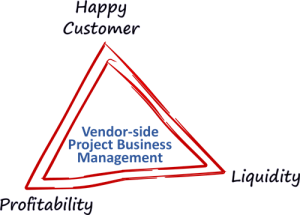

Figure 2: The Magic Triangle of customer projects. All three corners are equally important to protect the presence and the future of the company.

Figure 2: The Magic Triangle of customer projects. All three corners are equally important to protect the presence and the future of the company.

Laying out a game-theoretical model for games with one player, such as the card game Solitaire, I am showing that more aspects of project business need to be considered, particularly the profitability of the project for the vendor and its impact on the company’s liquidity, as shown in Figure 2. It cannot be the goal of a project to lead the vendor into insolvency, which would also incapacitate the company to satisfy the customer.

A Project for a Paying Customer

The First Decision: Winning the Contract or Stepping Back?

Sandworm, Inc.[1], was certain to have won the best project contract in the company’s history. It was a fixed price contract to deliver and implement a business software solution for Wolf Spider Corp. at a value of US $100 million over a period of nine months. To make the project even more attractive, the contract included a commitment by the customer to add an incentive of 10% on top if they would finish the project two months early. Sandworm had done similar projects in the past and felt it was in a good position to meet the seven months incentive date which would make project very profitable and would also ensure a happy customer.

Three aspects of the project seemed less favorable, one being that the bulk of the payment was to be made by the customer after delivery. Sales people had tried to negotiate better payment terms that would be less straining for the contractor, but the customer made it clear that no payment would be made before the software was running and its ability to meet the customer’s requirements would be proven, and insisted that otherwise “…there are many other providers, who are happy to do the business under our conditions.”

Another detriment was a liquidated damage clause of $20 million that would apply in the case of late delivery and would be deducted from the fixed price.

The most unfavorable passage of the contract was a performance guarantee in support of the customer. It said that if Sandworm was found unable to deliver at all, the customer would be permitted to immediately terminate the contract. In such a case, the customer would not pay anything to the contractor but the liquidated damages would still apply, meaning Sandworm would have to pay $20 million to the buyer. The same would apply if Sandworm terminated the contract before the project was finally finished.

More…

To read entire article, click here

Editor’s note: This series of articles is by Oliver Lehmann, author of the book “Project Business Management” (ISBN 9781138197503), published by Auerbach / Taylor & Francis in 2018. See author profile below.

How to cite this article: Lehmann, O. (2019) When There is No Way Out – The Sunk Cost Dilemma, PM World Journal, Vol. VIII, Issue III (April). Available online at https://pmworldlibrary.net/wp-content/uploads/2019/03/pmwj80-Apr2019-Lehmann-Sunk-Cost-Dilemma.pdf

About the Author

Oliver F. Lehmann

Munich, Germany

![]()

Oliver F. Lehmann, MSc., PMP, is a project management author, consultant, speaker and teacher. He studied Linguistics, Literature and History at the University of Stuttgart and Project Management at the University of Liverpool, UK, where he holds a Master of Science Degree. Oliver has trained thousands of project managers in Europe, USA and Asia in methodological project management with a focus on certification preparation. In addition, he is a visiting lecturer at the Technical University of Munich.

He has been a member and volunteer at PMI, the Project Management Institute, since 1998, and served five years as the President of the PMI Southern Germany Chapter until April 2018. Between 2004 and 2006, he contributed to PMI’s PM Network magazine, for which he provided a monthly editorial on page 1 called “Launch”, analyzing troubled projects around the world.

Oliver believes in three driving forces for personal improvement in project management: formal learning, experience and observations. He resides in Munich, Bavaria, Germany and can be contacted at oliver@oliverlehmann.com.

Oliver Lehmann is the author of “Situational Project Management: The Dynamics of Success and Failure” (ISBN 9781498722612), published by Auerbach / Taylor & Francis in 2016 and of “Project Business Management” (ISBN 9781138197503), published by Auerbach / Taylor & Francis in 2018.

To view other works by Oliver Lehmann, visit his author showcase in the PM World Library at https://pmworldlibrary.net/authors/oliver-f-lehmann/

[1] All names changed.