Practical Project Risk Management

SERIES ARTICLE

By Martin Hopkinson

United Kingdom

Purpose

Provide a means of modelling the magnitude and range of risk impacts or effects.

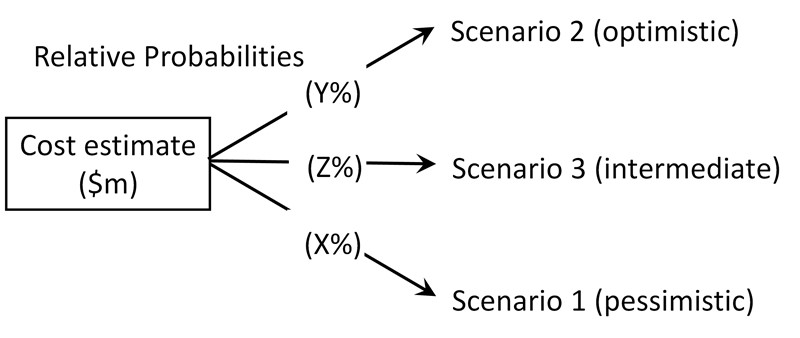

Three-point scenario estimates are used as inputs to quantitative risk analysis and are typically made for the schedule, cost or and/or economic benefit effects of project risk. They are an alternative to the more frequently used and simpler three-point estimates technique. A key advantage is that they require a purposeful exploration of the implications of optimistic and pessimistic scenarios, thus potentially developing fresh insights. The same principles can be used to explore additional scenarios, by for example developing a four-scenario estimate.

General Approach

This general approach to risk estimating has been described by Chapman and Ward and can be represented as being analogous with the structure of decision trees.

It is recommended that the pessimistic and optimistic scenarios should be described and estimated first. This requires the estimator to identify and consider all significant sources of uncertainty before estimating the intermediate case, thereby avoiding anchoring bias.

A Recommended Estimating Approach

Intuitive risk estimates tend to be too narrow. Thus, although the typical product of the approach recommended below may be perceived (intuitively) to be too wide, it is likely to be more realistic than thought. Note that, when making the intermediate case estimate, it should not be assumed that this is the planned (baseline) value. One of the benefits of this approach is that, by understanding the pessimistic and optimistic scenarios first, a refreshed and balanced context can be identified before making the intermediate estimate.

- Identify and make a rounded point estimate for the outcome of a pessimistic scenario.

- Identify and make a rounded point estimate for the outcome of an optimistic scenario.

- Identify and make a rounded point estimate for the outcome of the intermediate scenario.

- Estimate outcome boundaries for each scenario. The simplest approach is to derive them by calculating midpoints between adjacent scenarios.

- Estimate the probability of occurrence of the pessimistic scenario.

- Estimate the probability of occurrence of the optimistic scenario.

- Derive the probability of occurrence of the intermediate case scenario, by subtracting the sum of the probabilities estimated in steps 5 and 6 above from 1.0 (or 100%). If necessary, adjust the three probabilities to ensure that that their relative probabilities are realistic.

- Use rectangular probability distributions for each scenario to construct the overall probability density function (PDF) for the risk estimate.

The figure below illustrates how a PDF is estimated using this approach.

More…

To read entire article, click here

Editor’s note: This series of articles is by Martin Hopkinson, author of the books “The Project Risk Maturity Model” and “Net Present Value and Risk Modelling for Projects” and contributing author for Association for Project Management (APM) guides such as Directing Change and Sponsoring Change. These articles are based on a set of short risk management guides previously available on his company website, now retired. For an Introduction and context for this series, click here. Learn more about Martin Hopkinson in his author profile below.

How to cite this article: Hopkinson, M. (2022). Three-scenario Estimates: A brief guide, Practical Project Risk Management series, PM World Journal, Vol. XI, Issue XII, December. Available online at https://pmworldlibrary.net/wp-content/uploads/2022/11/pmwj124-Dec2022-Hopkinson-three-scenario-estimates-risk-management-article.pdf

About the Author

Martin Hopkinson

United Kingdom

![]()

Martin Hopkinson, recently retired as the Director of Risk Management Capability Limited in the UK, and has 30 years’ experience as a project manager and project risk management consultant. His experience has been gained across a wide variety of industries and engineering disciplines and includes multibillion-pound projects and programmes. He was the lead author on Tools and Techniques for the Association for Project Management’s (APM) guide to risk management (The PRAM Guide) and led the group that produced the APM guide Prioritising Project Risks.

Martin’s first book, The Project Risk Maturity Model, concerns the risk management process. His contributions to Association for Project Management (APM) guides such as Directing Change and Sponsoring Change reflect his belief in the importance of project governance and business case development.

In his second book Net Present Value and Risk Modelling for Projects he brought these subjects together by showing how NPV and risk modelling techniques can be used to optimise projects and support project approval decisions. To learn more about the book, click here

To view other works by Martin Hopkinson, visit his author showcase in the PM World Library at https://pmworldlibrary.net/authors/martin-hopkinson/