Practical Project Risk Management

SERIES ARTICLE

By Martin Hopkinson

United Kingdom

Purposes

- Produce a realistic risk-based forecast for the cost of project ownership.

- Assess appropriate financial provisions for cost risk.

- Forecast the effect on cost risk of changes to project scope or contractual agreements.

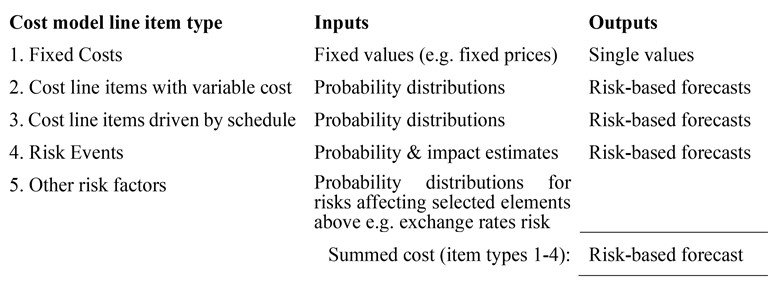

Typical cost risk model structure

Cost risk effects combinations can be complex. See the Multiplicative Risk Effects guidance sheet (October 2022). It is also often necessary to differentiate between costs that are driven by schedule performance and other costs that are not. Since there is no simple repeatable way of structuring cost risk models, an appropriate structure should be developed for each project. However, a structure similar to that illustrated below may be appropriate in many cases.

The simplest approach is to calculate single value outputs for each line item deterministically. A better approach is to use a structure such as that illustrated to prepare a model for Monte Carlo Simulation. This would be necessary if compound risks or other risk factors are included.

Illustration of a Monte Carlo Cost Model Output

The provision for cost risk may be referred to using terms such as risk fund, risk reserve, or risk contingency. This should be differentiated from any contingency provisioned for the effects of unidentified risk (or unknown unknowns), which cannot be estimated by this approach to analysis…

More…

To read entire article, click here

Editor’s note: This series of articles is by Martin Hopkinson, author of the books “The Project Risk Maturity Model” and “Net Present Value and Risk Modelling for Projects” and contributing author for Association for Project Management (APM) guides such as Directing Change and Sponsoring Change. These articles are based on a set of short risk management guides previously available on his company website, now retired. For an Introduction and context for this series, click here. Learn more about Martin Hopkinson in his author profile below.

How to cite this article: Hopkinson, M. (2023). Cost Risk Analysis: A brief guide, Practical Project Risk Management series, PM World Journal, Vol. XII, Issue VIII, August. Available online at https://pmworldlibrary.net/wp-content/uploads/2023/08/pmwj132-Aug2023-Hopkinson-cost-risk-analysis-a-brief-guide.pdf

About the Author

Martin Hopkinson

United Kingdom

![]()

Martin Hopkinson, recently retired as the Director of Risk Management Capability Limited in the UK, and has 30 years’ experience as a project manager and project risk management consultant. His experience has been gained across a wide variety of industries and engineering disciplines and includes multibillion-pound projects and programmes. He was the lead author on Tools and Techniques for the Association for Project Management’s (APM) guide to risk management (The PRAM Guide) and led the group that produced the APM guide Prioritising Project Risks.

Martin’s first book, The Project Risk Maturity Model, concerns the risk management process. His contributions to Association for Project Management (APM) guides such as Directing Change and Sponsoring Change reflect his belief in the importance of project governance and business case development.

In his second book Net Present Value and Risk Modelling for Projects he brought these subjects together by showing how NPV and risk modelling techniques can be used to optimise projects and support project approval decisions. (To learn more about the book, click here.)

To view other works by Martin Hopkinson, visit his author showcase in the PM World Library at https://pmworldlibrary.net/authors/martin-hopkinson/